Miles Education CPA Fees: Making Your Investment Worth it

When choosing a professional certification, we understand that you’re not just paying for a course; you’re investing in your future.

With Miles Education, your decision to choose a CPA journey becomes a strategic decision that should deliver an unmatched return over a lifetime.

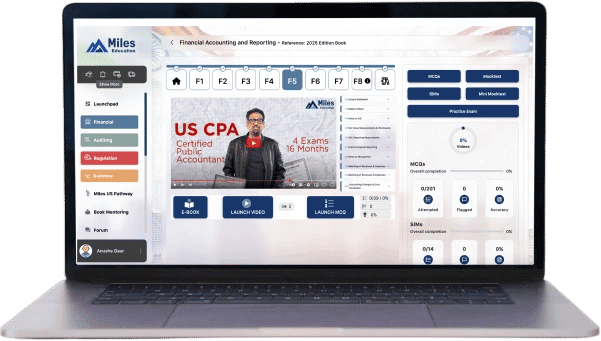

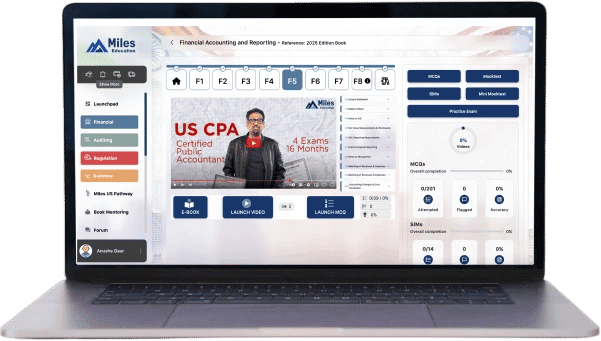

What sets Miles Education apart is its fully integrated ecosystem designed to support you from start to finish and make spending your CPA fees in India worth the long-term value.

Engage with Varun Jain, the world’s favorite CPA instructor, and 100+ global educators and industry experts.

Varun Jain, CPA, CMA

Harvard B - School Alumnus

End-to-end support, including eligibility, evaluation, NTS application, Prometric scheduling, credit bridging, and licensing.

Full access to video lectures, MCQs, simulations, mock exams, and live classes.

Access to comprehensive study materials powered by McGraw-Hill.

Receive one-on-one mentoring and personalized guidance.

3 years of free access to Miles Masterclass post-licensure (worth $1,200) with global CPEs.

Beyond academics, Miles has built strong partnerships with Big 4 firms and top MNCs, giving students access to real placement opportunities in both India and the U.S., commanding premium salaries annually. In India, CPAs can earn ₹10-20 LPA, and in the U.S., CPAs can earn $70,000-$130,000+ annually.

So, if you're committed to becoming a US CPA, Miles Education is the partner you can count on.