Certified Public Accountant:

Everything You Need to Know

The CPA is a globally recognized accounting qualification that represents the pinnacle of credibility and trust in the accounting profession.

A Certified Public Accountant (CPA) is a licensed accounting professional qualified to handle financial reporting, audits, taxation, compliance, and advisory services.

While the term CPA is used internationally, the most recognized qualification is the US CPA, which is granted by individual State Boards of Accountancy in the United States and is governed by the American Institute of Certified Public Accountants (AICPA)

The US CPA is a globally respected credential known for its rigorous standards, ethical focus, and career portability. Its emphasis on professionalism and technical expertise makes it a top choice for accountants looking to earn the CPA license, boost credibility, and grab global opportunities.

What is the Meaning of CPA in Accounting?

The CPA course’s full form is Certified Public Accountant, and if you're looking to build a career as a global accountant, here’s a breakdown of the US CPA course details that every aspirant needs to know.

in financial reporting

In today’s financial landscape, a Certified Public Accountant plays a vital role as a strategic advisor and ethical financial leader.

CPA Exam Overview (US CPA)

FAR (Financial Accounting & Reporting)

AUD (Auditing & Attestation)

REG (Taxation & Regulation)

BAR (Business Analysis & Reporting) [or other discipline options]

Certified Public Accountant Certification vs License

CPA Certification Process

It confirms that you’ve passed all 4 CPA exams.

CPA License

Granted by a U.S. state board, after meeting education, ethics, and experience requirements.

At Miles, we're committed to guiding you through the complete US CPA course from evaluation to exam prep to earning your license. Our emphasis on expert faculty and personal mentorship makes us a trusted choice for Indian students pursuing global accounting careers.

The American Institute of Certified Public Accountants is the world’s largest member association for accountants. It develops the CPA exam, sets professional standards, and governs the CPA profession in the U.S.

Being a CPA means aligning with AICPA’s global standards, a hallmark of quality in accounting.

How to Become a Certified Public Accountant?

Becoming a CPA requires meeting U.S. state education requirements, passing all four sections of the CPA Exam, completing relevant work experience, and obtaining a state license.

Indian degrees are accepted after a foreign credential evaluation, and the process typically takes 12 to 18 months.

For Indian aspirants, structured guidance can make the journey smoother. Miles Education offers support with eligibility evaluation, exam planning, study resources, and mentorship to help candidates navigate the CPA pathway confidently.

AICPA: The Body Behind the CPA

The American Institute of Certified Public Accountants is the world’s largest member association for accountants. It develops the CPA exam, sets professional standards, and governs the CPA profession in the U.S.

Being a CPA means aligning with AICPA’s global standards, a hallmark of quality in accounting.

CPA Recognition in India & Abroad

While CPA is recognised globally, it’s important to understand some fundamental differences if you intend to get your certification in another country. Here’s how they compare:

If you're considering the best option, the US CPA is a more widely popular credential for Indian professionals. This is because it's widely preferred by Big 4 firms, top CPA firms, MNCs, and Global Capability Centres. Additionally, it also opens doors to top finance and compliance roles in Indian companies dealing with U.S. markets.

Is a Certified Public Accountant Right for You?

Getting started with a CPA admission could be your best career move. CPA represents the highest standards of competence, integrity, and professionalism in the accounting industry, and is perfect for you if you are:

A B.Com/M.Com/BBA/MBA/CA/

ACCA student or graduate

A Finance or accounting professional, or even an Indian CA, aiming for global roles

Looking to work in India or abroad (especially the U.S. or the Middle East)

Interested in taxation, audit, advisory, or controllership.

Why Choose Miles?

Learn From the World’s Favourite CPA Instructor - Varun Jain

Varun Jain, CPA, CMA

Harvard B - School Alumnus

Engage with Varun Jain, CPA, CMA, Harvard B-School Alumnus who has empowered 70K+ students to become the flag bearers of Indian accounting talent globally.

Access 100+ Global Educators & Industry Experts

Access 100+ Global Educators & Industry Experts

Learn from a vast network of industry leaders to enhance your understanding.

End-to-End License Support

One-on-one guidance by the Gameplan Team for CPA eligibility, state board selection, evaluation, NTS, Prometric scheduling, and the license.

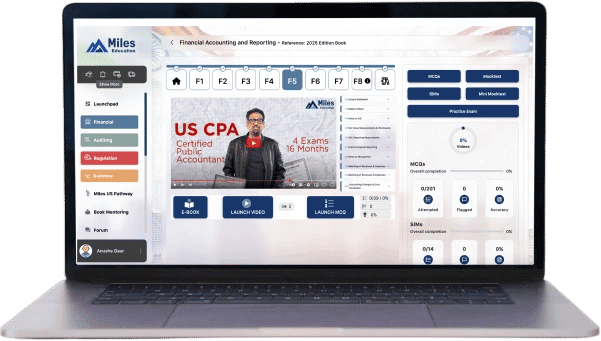

The Miles CPA LMS - Your Ultimate CPA Tool Kit

Video Lectures

MCQs

Simulations

Mock Exams

Sunday Live Classes

Free Masterclass Subscription after CPA

Earn free CPEs from Miles Masterclass conducted by global faculty for 3 years after license (worth $1,200).

Kickstart Your CPA Career Here

Step into global careers, top salaries, and leadership opportunities

Register for the AI-Ready CPA Webinar

Frequently Asked Questions

Already enrolled? Log in to continue learning.

Login