Be an AI-ready EA

(Enrolled Agent) in 2026

Earn 50L+ per annum- Authorized U.S. Tax Practitioner

- 3 Exams | 6 Months

- Jobs at Big 4 & MNCs in India & U.S.

Want to be an

AI-Ready Accountant?

Connect with an Expert

EA = U.S. Tax Practitioner

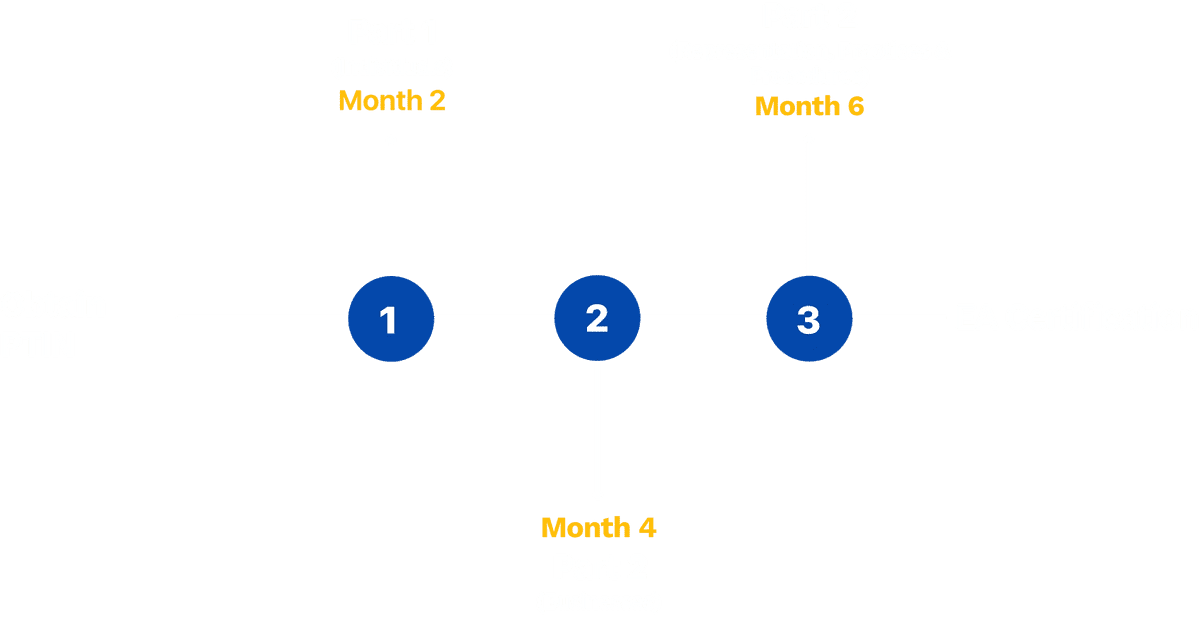

3 Exams | 6 Months

Pursue with full-time job:20 hrs study/week

6-month timeline:1 exam every 2 months

Exam by IRSInternal Revenue Service

Only 3 parts:Individual | Businesses | Representation, Practice & Procedures

Jobs at Big 4 & MNCs in India & U.S.

Our premier tie-ups with top companies

Avg. Salary in India

₹6 lakhs+

Work at Big 4 & 220+ MNCs

Avg. Salary in USA

₹50 lakhs+

Work at 350+ CPA firms

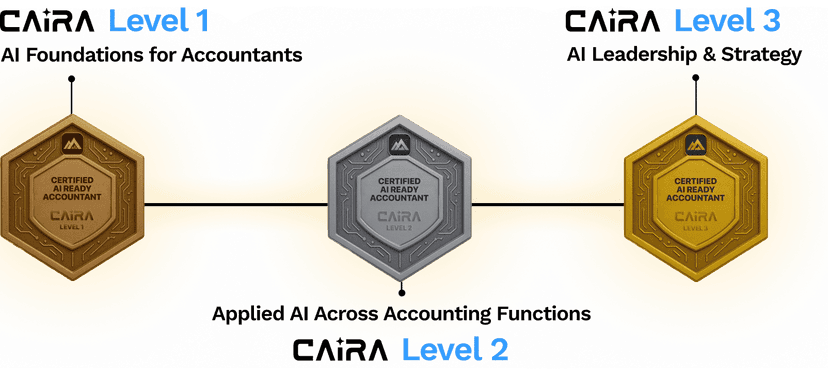

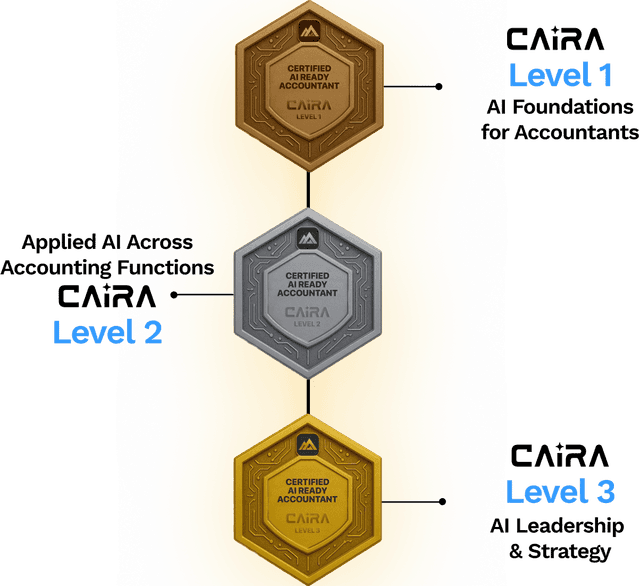

Certified AI-Ready Accountant (CAIRA)

The AI capability layer for every accountant

CAIRA equips CPAs and CMAs with practical, job-ready AI skills across analytics, automation, audit, tax, and advisory.

The CAIRA Pathway

#EAmatlabMiles

Learn From the World’s Favourite CPA Instructor - Varun Jain

Varun Jain, CPA, CMA

Harvard B - School Alumnus

100+ Instructional Video Lectures

One-on-One Mentoring & Support

Placement Assistance in

India & USA

Integrated IRS

Publications

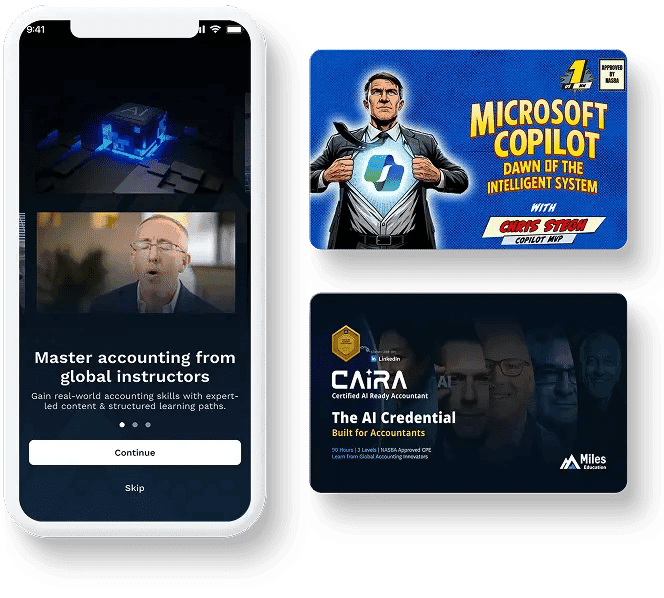

Learn on-the-go with

Miles One App

LMS From Fast Forward Academy - Your Ultimate EA Tool Kit

Video Lectures

Digital Flashcards

Mock Exams

3000+ Study Questions

Training via Live Online Coaching

FREE: CAIRA - Level 1 (Certified AI-Ready Accountant)

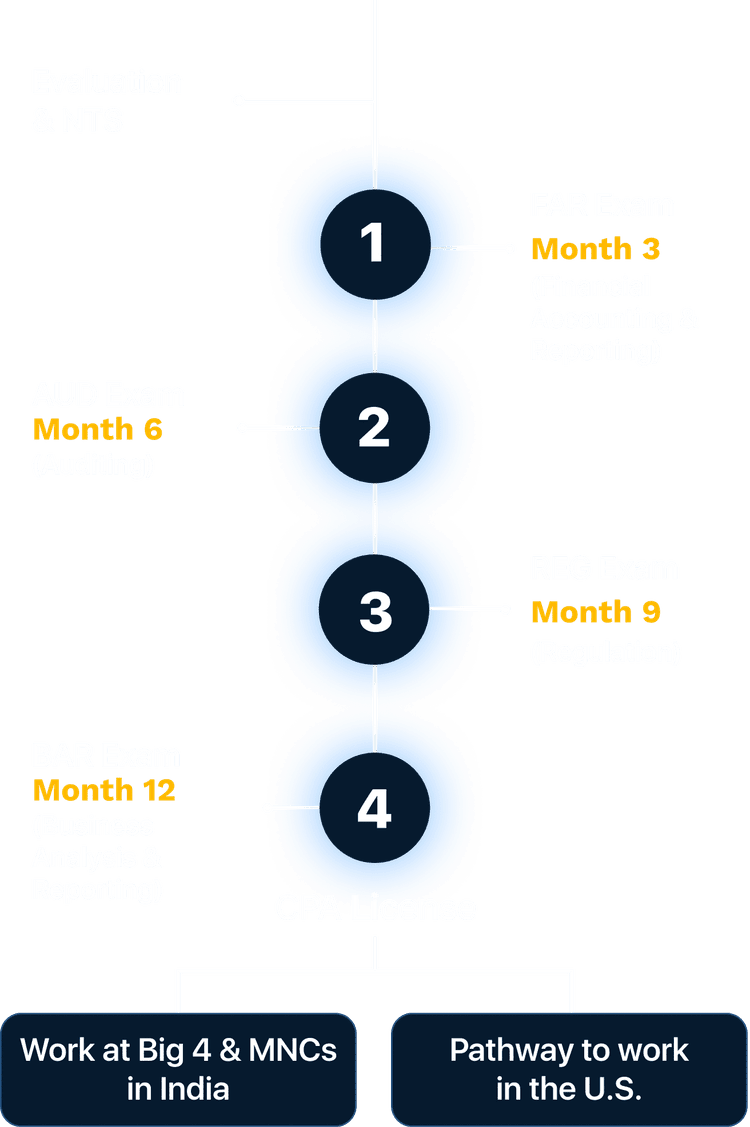

Your EA Gameplan

Your journey to EA License and getting placed

Next Batch Starts on 18 Jan 2025

Download the

Miles One App

to be an AI-Ready Accountant